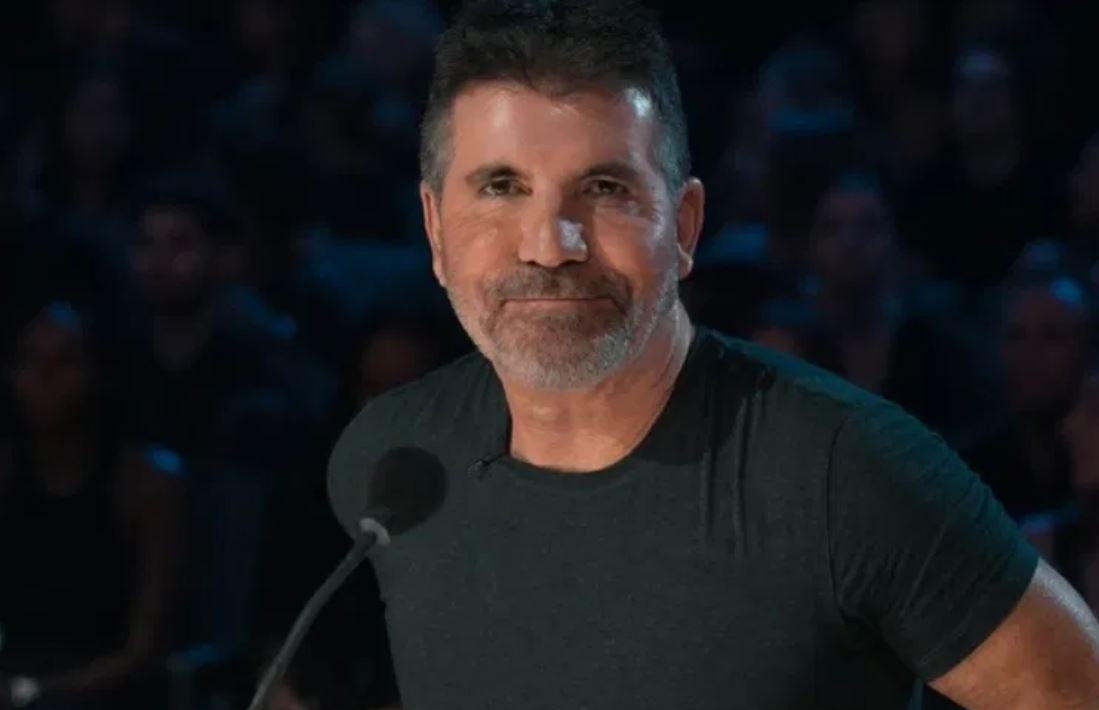

After his son Eric was born, Simon Cowell’s life would never be the same. He talked about how Eric’s birth brought light and meaning into his life during a time of great grief and struggle in a recent podcast interview. Cowell was too busy with work and sad because he had lost both of his parents, Julie and Eric.

When Cowell heard that Lauren was pregnant, it changed everything. As he got ready to become a dad, he started to think about his goals again and find a new reason for living. Cowell thought back with fondness on the simple pleasures of being a parent, like watching movies with Eric and feeling the unbridled joy that kids bring to life.

Cowell said that Eric gave him peace and hope when things were the worst. He admitted that he had been lost and without purpose before Eric was born, but that the birth of his son had helped him find the beauty of life. Cowell said Eric’s love and excitement changed his life and taught him to enjoy every moment and find happiness in small things.

As Cowell dealt with the difficulties of being a father and his busy job, he felt more fulfilled than ever. He was open and honest about how much Eric has changed his life, showing how love and family can change things. Cowell learned to appreciate the beauty of life and how important it is to live in the present through Eric’s contagious excitement.

Even now, Cowell is thankful for how much Eric has changed his life. He loves every moment he spends with his son and finds comfort and joy in the simple things that come with being a parent. The strong bond between Cowell and Eric shows how love can last forever and how strong the human spirit is.