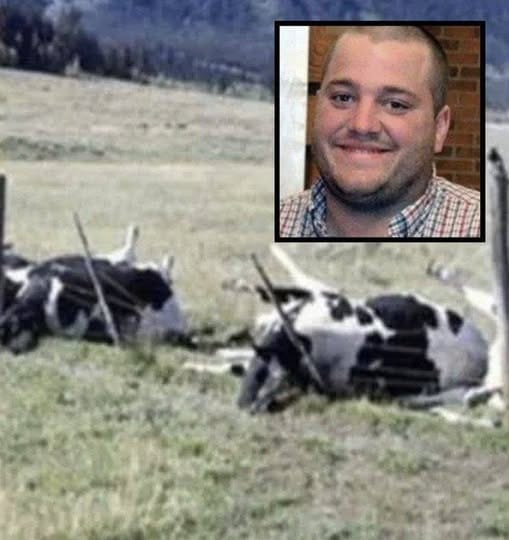

A terrible accident on a farm in Wisconsin has shocked the whole area and left a family in grief.

Investigators say that a “deadly dome of air” formed over the tank and trapped methane and sulfur oxide fumes that killed Michael and the animals. The accident happened while the tank was being set up for pumping, and bad weather made a perfect storm that caused the accident.

Robert Biadasz, Michael’s father, said that the event was a sad mix of unplanned events. The warm top air produced a bubble of air that kept the gases from leaving, which hurt Michael and the cows.

The exact reason Michael died is still being looked into by the coroner’s office, but it’s clear that the accident was shocking and out of the blue. A lot of times before, Michael had safely emptied the tank. Michael’s family is still trying to understand what happened.

The Biadasz family put trucks and other heavy equipment in a line along the road near the farm as a tribute to Michael. There is Michael’s black pickup truck, a few red cars, and a blue tractor at the tribute.

Concerns have been made about the safety of manure holding tanks and the need for stricter rules to stop similar accidents from happening again. The National Agriculture Safety Database says that these kinds of buildings should have enough air flow and warning signs to keep workers and animals safe from dangerous gases.

The tragedy has also shown how dangerous farming can be and how important it is to take safety steps to avoid accidents. Someone wrote, “Farmers are already in a lot of danger, and this family had to go through this freak accident.” I feel so sad about it.”