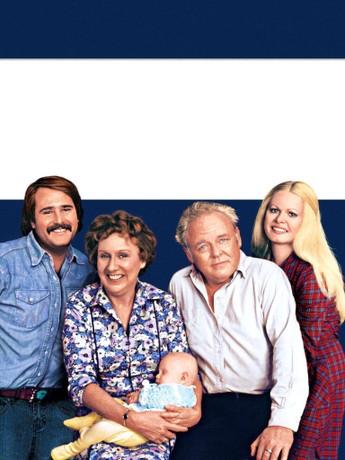

The cultural air I breathed as a kid in 1970s Texas was thick with unchallenged assumptions. Bias was casual, routine, and woven into the social fabric. From this environment, I absorbed a worldview with clear, unjust hierarchies. I lacked a counter-argument, a model for dissent. That model arrived in the form of a sitcom character derisively nicknamed “Meathead.” On “All in the Family,” Rob Reiner’s portrayal of Michael Stivic did more than provide comic relief; he offered a masterclass in using empathy as an instrument for justice, fundamentally altering the trajectory of my own values.

The show’s central conflict was a microcosm of America’s culture wars. Archie Bunker embodied the defensive, fearful clinging to tradition and prejudice. Meathead represented the patient, often frustrated, insistence on a more inclusive and compassionate future. What resonated deeply was that Meathead’s arguments were emotionally intelligent. He didn’t just cite facts; he appealed to Archie’s capacity for understanding, trying to bridge the gap with shared humanity. In a world where disagreements in my own life were often shut down with finality, this demonstrated a powerful alternative: engagement rooted in respect.

This was my first exposure to the idea that ethical living requires active participation. Meathead taught me that principles are meaningless if you don’t defend them in everyday encounters. His character made the concept of “social justice” personal and immediate. It wasn’t about protesting faraway injustices (though that mattered too), but about confronting the racist joke at the local diner, or questioning the sexist remark from a relative. The show validated my growing sense that the world around me was morally flawed and, crucially, showed me that one person’s consistent pushback could matter.

That validation sparked a quiet, lifelong revolution. The lessons from those TV episodes became the bedrock of my adult perspective. “All in the Family” gave me the courage to exchange passive acceptance for active empathy, to believe that challenging ignorance is a form of care—for both the victim of prejudice and the person trapped by it. In honoring Meathead’s legacy, I strive to bring that same stubborn, compassionate conviction to my own interactions, proving that sometimes the most profound teachers come not from pulpits or podiums, but from the flickering screen in a suburban living room.